As an effect of COVID-19, the adoption of digital payment is increasing across users. The digital payment platforms are witnessing all of a sudden sharp jump in the number of users as a cash transaction volumes decline across many countries.

As per Statista estimate, total transactions through digital payments will reach US$4, 406, 413m in the year 2020 with a YoY rise of 17%. It is fair to infer that spread of COVID-19 has acted as a growth driver for digital payment.

Circumstances fueling the adoption of digital payments:

Due to the spread of COVID-19, businesses and consumers are moving away from using cash and checks for payments as cash is seen as a potential carrier of the virus. Nevertheless, the daily needs of grocery and essential items people are still using cash despite the health risk.

With bank branches either closed or working with minimum staff and restrictions like curfew and travel ban making it difficult for businesses to deposit cash into their bank accounts. Banks are suggesting users adopt online banking services from their phone instead of cash. Subsequently both customers and businesses are switching to digital payments.

Types of digital payment methods with underlying technologies:

Digital transactions are free from any physical contact between people. These include new payment channels like wearables, voice or chat-bot payment, etc. Below are some of the digital payment modes using that can help ease payments in this COVID-19 situation.

Digital Wallets

Digital wallet technology provides quick payment options. Unlike net-banking, it does not require adding account beneficiary and waiting before initiating a transaction. With this, the customers and retailers can complete their transactions securely using QR code scanning or UPI based payment using mobile apps.

QR and UPI based payments are getting popularity in this COVID-19 situation in modern payment apps and devices. QR codes can be scanned from paper and screen when customers request to pay via QR code or UPI then the merchant needs to select “QR code” or “UPI payment” options on his PoS terminal and input bill amount. This will generate a dynamic code on the PoS screen which can be scanned by any android/iOS mobile-based QR app or UPI app to improve the customer experience. QR codes and UPI improve customer experience with instant payments, fool-proof security, and reduces transaction errors.

Wearable devices

According to a wearable payment market report, the analyst forecasts the global wearable payment market to grow at a CAGR of 59.44% during the period 2016-2020.

Wearable payment refers to transactions between wearable devices and contactless payment terminals like NFC. NFC uses high-frequency wireless communication technology that enables peer-to-peer communication between two devices. End-users use this secure technology to transfer information from their devices to contactless payment terminals such as smartphones and NFC tags.

Wearable technology helps to reduced 1. Costs of adopting NFC acceptance at merchants 2. A near-ubiquity of contactless acceptance at POS terminals and 3.The expanded adoption of event-specific wearable devices at outdoor events like festivals and concerts.

To improve customer experience, wearable payment device manufacturers are adopting technologies where many cards can link with single NFC wearable devices and prioritize payment options and actions. The embedded NFC solutions in smartwatches, jewelry, and clothing enable users to seamlessly link an existing payment card, via their mobile phone and activate the payment service.

The development in wearable payment opens the door to the next secure payment challenge – embedding secure payment authentication into connected IoT devices.

Common wearable payment devices in the market are wristbands – Apple Watch, Samsung Gear with Samsung Pay, Jawbone’s Fitness Tracker with NFC integration with Amex Card. While these are general payment modes acceptable at a wide range of commercial establishments, wearables like Disney’s Magic Bands support NFC linked payments within its resorts.

Contactless Card Payment

According to the International Card Manufacturers Association (ICMA)’s 2020 State of the Card Industry, North America ranked second (behind the Asia Pacific region) with 9.5 billion cards manufactured in 2019, which was a 3.2% increase compared to 2018. The growth was a result of accelerated contactless conversion.

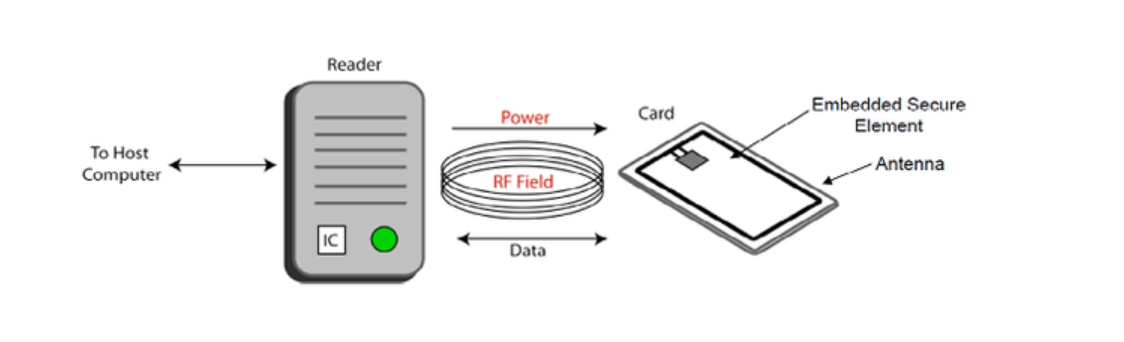

When EMV cards started using chip technology instead of magnetic tape and contactless payment technology came into the picture. The contactless card is equipped with chips and embedded antenna which allows transactions via handled secure radio frequency signal into the POS terminal and the chips. One of the key advantages of adopting this technique by merchants and issuers is the transaction speed and ease of transactions. Many merchants are on the verge of accepting contactless payment which is converted to EMV- enabled POS terminals using radiofrequency field generated by terminals.

Wrapping up

The adoption rate of digital payment was slow until 2019. The COVID-19 pandemic has increased the adoption of digital payments drastically. Beyond this COVID-19 crisis, an increasing number of smart devices that support payment will drive the growth of digital payments.

eInfochips provides complete EPOS and mPOS product design and development services for the retail and payment sector. eInfochips EPOS SDK enables features like contactless payments, RFID technology, battery operational support, POS, wireless connectivity via 3Gm Wi-Fi and NFC support, etc. To learn more about our digital transformation offerings in the retail, payment, and telecommunication sector. Please get in touch with us today.